If you’re away at school temporarily and are staying in residence, your parents’ home insurance policy will cover you. If you move out permanently you will need to buy your own tenant insurance.

You’re legally responsible for the damage if something happens that could have been avoided with proper care. For example:

- Your washing machine overflows

- You forget to turn off a tap and water overflows into the unit below

That’s why home insurance is a must for all tenants as well as homeowners. It provides liability insurance for damages that you cause to someone or something in your building, or to the building itself. Without this coverage you’ll have to pay for the damages in full.

Municipal waterworks can handle normal, or slightly above normal water flow. However, sewers can back up following heavy precipitation, melting snow, a sudden thaw, a rise in the water table, or other unexpected weather conditions. Fortunately, you can minimize the risk to your house or apartment by following these loss prevention tips:

Install a Backwater Valve

A backwater valve that complies with your municipality’s standards and bylaws will prevent sewage from backing up into your basement. The valve closes automatically if the sewer backs up.

Maintain your Backwater Valve

Proper care of your plumbing system will significantly reduce the risk of sewer backup.

You should purchase enough coverage to protect all of your belongings, including your clothing, furniture, electronic equipment, computer and kitchen appliances. Don’t forget anything! People often underestimate the value of their belongings. Make sure you have sufficient coverage for everything you own. We recommend taking an inventory by going through your home room by room and recording everything in detail. When you’re finished, calculate what it would cost to replace all of it.

You can lower your home insurance premium with some simple steps:

Install a centrally monitored alarm system. This provides a discount.

Take preventive measures to lower the number of claims you make. Every claim increases your “risk assessment” which in turn increases your policy cost.

Make sure that no one in your household smokes.

Yes, coverage can be arranged to cover up to two roommates under the same home insurance policy, however if you and your spouse move in together, and you decide to share the apartment with another couple, each couple will need a separate home insurance policy.

You’ll need your plates, insurance and registration papers. Don’t scrap these! The vehicle’s title of ownership will also have to be transferred to the person you’re selling (or giving) the vehicle to. This will ensure you’re no longer listed as the owner. To transfer ownership, both of you will need to sign a Transfer/Tax form. You can pick one up at any Nakamun Group insurance office. We definitely recommend going together with the buyer to the broker’s office to complete the transfer.

Don’t worry, it’s usually not too hard to get the documents you need. The first thing we suggest you do is ask the person selling the car to go to an insurance broker to replace the missing vehicle registration. If you’re unable to contact the seller, that’s OK. Your Nakamun Group insurance broker can help direct you in the steps you need to take, which will differ in each province.

You both do. And the easiest way to complete your sale is to go to your Nakamun Group insurance broker together with the buyer and handle all of the paperwork in the broker’s office. Don’t forget to bring your plates!

Yes you can, as long as the vehicle is roadworthy and operationally safe, with no structural damage. The cash settlement amount will take into account the cost of repairs, excluding taxes. Ask your adjuster to find out what your cash settlement would be and then you can decide if you want to fix your vehicle yourself.

Unfortunately, no. Although we understand you might want to help your friend out and make the claim under your insurance, you wouldn’t be able to. Although the rules can change depending on where you live, the responsibility for a claim usually goes to whoever the car is licensed and insured to (your friend), not to who’s driving it at the time and gets in the crash (you).

Since the golf club most likely can’t be held responsible for damage caused by any players on its course, you should make a claim. The good news is that you’re protected by own Comprehensive insurance, which will cover the repairs for damage caused by flying objects like golf balls.

You could receive a traffic ticket. To learn more, review the seatbelt laws in your province. The courts would determine if you were responsible for contributing to a passenger’s injuries by not making sure they had their seat belt on, considering the circumstances of the crash, including the age and competence of the passenger. Keep in mind a passenger without a seatbelt poses a high risk to everyone a vehicle in the event of a crash. If you were in a head-on collision at 50 km/h, a 150-pound passenger not wearing a seatbelt would strike you or other passengers in the vehicle with the same weight as a 3 ½-ton truck.

When you buy coverage for damage to your own car, you choose a deductible amount. This is the uninsured portion of a claim and the amount you pay before your insurance policy comes into effect to pay for the rest. Having deductibles is standard in the insurance industry and helps keep insurance affordable. If the other driver is at fault and insured by us, your deductible may be reimbursed or waived. If the other driver doesn’t have insurance with the same insurance company, you or your adjuster need to request the reimbursement of your deductible from the other driver’s insurance company.

You don’t always have to call the police. However, you are required to make a police report in the following cases:

- There has been a death or someone has been taken to the hospital by ambulance

- It was a hit-and-run accident

- Someone broke into or vandalized your vehicle

- Your vehicle was stolen

A good rule of thumb is to call the police if you think the damage to your vehicle looks like it may be more than $1,000 (or $600 for a motorcycle and $100 for a bicycle). If the police don’t come to the accident scene, call your insurance company to find out if you have to get a police report.

A scooter is a limited speed motorcycle powered by gas engines 50 cc or less or electric motor less than 1,500 watts. All limited speed motorcycles need to registered, licensed and insured as a motor vehicle and the operator needs a driver’s licence.

Depending how often you do work-related deliveries, you might need more coverage. With pleasure use, you can also use your vehicle for limited commuting, business use and deliveries up to six days in a calendar month.

If you are responsible for the crash, it covers the other motorist’s repairs, the cost of damages and any injuries caused as a result of the crash. It is important to know that the costs of a claim can exceed the usual $200,000 liability that many people buy. For example, if your accident caused serious injuries to multiple parties, each one could sue you for the cost of their care, and it could involve lifetime care costing hundreds of thousands of dollars per person. If you had purchased only the minimum coverage, you would be responsible for the difference.

If your vehicle is off the road, or you intend to put it in storage, a Vehicle in Storage policy is what you want. It includes Collision, Comprehensive, Specified Perils, Basic and/or extended Third Party Liability insurance, as well as Replacement Cost Coverage and Limited Depreciation coverage for certain newer vehicles. The cost for a storage policy depends on the model and age of the car, and where it’s parked. Remember that it needs to be stored on private land and the Vehicle in Storage coverage is void if your vehicle is operated at any time during the policy.

When your teen becomes a new driver, check your coverage with your Autoplan broker to see how your insurance could be affected. You might have a type of insurance discount that no longer applies. For example, your insurance may require that all drivers in your household have 10 years of experience. In that case, you would need to update your coverage. Your insurance is also affected by your vehicle’s principal operator. This is the person who drives it the most. If your teen becomes the principal operator of your vehicle, your premiums will likely increase, because they haven’t driven long enough yet to get discounts for safe driving. Since your teen is a new driver, we also recommend getting some extra coverage, like Extension Third Party Liability or Collision. It helps to protect them, you, and your vehicle.

Your insurance expires at midnight on the expiry date. So yes, you have until the end of the day to get it renewed.

Yes, as long as your son’s friends have your permission to drive your vehicle, then they are covered by your policy. Remember that as the registered owner, you’re responsible and legally liable if someone you lend your vehicle to has an at-fault crash. In addition, it could affect your discount. You’ll also need to make sure anyone driving has a valid driver’s licence and that your car is properly insured for the way they’re using it, such as driving to work.

Term insurance policies cover the insured for a stated term. The most common type of term policies are Term 10 and Term 20 policies. For example, on these plans the premiums are fixed for 10 years or 20 years and they rise substantially as the insured ages. Most Term policies are renewable and convertible, meaning the coverage can be renewed and/or converted to a permanent plan without a medical.

Life insurance can be used for a number of reasons. Here are just a few:

Life insurance can replace your income if something happens to you. It can pay off a mortgage or a line of credit so your loved ones aren’t saddled with the challenge of dealing with it. It can cover your final expenses. It can act as an emergency fund. The money can be used to fund your child’s education. And it can provide estate preservation and creation. Life insurance is seen by many as an unselfish act because the money is not used for the insured, just their loved ones. Finally, it can provide valuable protection for tax liabilities.

In most instances, individual life insurance offers a much better value than mortgage insurance through a lender. Individual life insurance policies provide level coverage, the plan is portable, if you decide to switch homes or move to another bank, and the insurance company allows you to choose your own beneficiary. There are also substantial discounts to non-smokers and people who have a healthy lifestyle.

In contrast, mortgage insurance through the bank offers declining coverage and the bank is the insured party. The insurance cannot be transferred to another lender. Coverage ceases when the entire mortgage balance is paid off, and at that time your ability to get independent coverage may have changed — you may no longer even be insurable! In addition, there are generally no discounts given to non-smokers or people with a healthy lifestyle when obtaining insurance directly from the mortgage lender.

A personal life insurance policy is tailored to your needs, features to take into consideration would be what financial needs your beneficiaries require upon your death — including paying off the mortgage, replacing your income to maintain lifestyle, and providing for dependents.

Most Term policies renew automatically. The insurance company would require you to sign a letter to cancel the policy.

If you’re away at school temporarily and are staying in residence, your parents’ home insurance policy will cover you. If you move out permanently you will need to buy your own tenant insurance.

You’re legally responsible for the damage if something happens that could have been avoided with proper care. For example:

- Your washing machine overflows

- You forget to turn off a tap and water overflows into the unit below

That’s why home insurance is a must for all tenants as well as homeowners. It provides liability insurance for damages that you cause to someone or something in your building, or to the building itself. Without this coverage you’ll have to pay for the damages in full.

Municipal waterworks can handle normal, or slightly above normal water flow. However, sewers can back up following heavy precipitation, melting snow, a sudden thaw, a rise in the water table, or other unexpected weather conditions. Fortunately, you can minimize the risk to your house or apartment by following these loss prevention tips:

Install a Backwater Valve

A backwater valve that complies with your municipality’s standards and bylaws will prevent sewage from backing up into your basement. The valve closes automatically if the sewer backs up.

Maintain your Backwater Valve

Proper care of your plumbing system will significantly reduce the risk of sewer backup.

You should purchase enough coverage to protect all of your belongings, including your clothing, furniture, electronic equipment, computer and kitchen appliances. Don’t forget anything! People often underestimate the value of their belongings. Make sure you have sufficient coverage for everything you own. We recommend taking an inventory by going through your home room by room and recording everything in detail. When you’re finished, calculate what it would cost to replace all of it.

You can lower your home insurance premium with some simple steps:

Install a centrally monitored alarm system. This provides a discount.

Take preventive measures to lower the number of claims you make. Every claim increases your “risk assessment” which in turn increases your policy cost.

Make sure that no one in your household smokes.

Yes, coverage can be arranged to cover up to two roommates under the same home insurance policy, however if you and your spouse move in together, and you decide to share the apartment with another couple, each couple will need a separate home insurance policy.

You’ll need your plates, insurance and registration papers. Don’t scrap these! The vehicle’s title of ownership will also have to be transferred to the person you’re selling (or giving) the vehicle to. This will ensure you’re no longer listed as the owner. To transfer ownership, both of you will need to sign a Transfer/Tax form. You can pick one up at any Nakamun Group insurance office. We definitely recommend going together with the buyer to the broker’s office to complete the transfer.

Don’t worry, it’s usually not too hard to get the documents you need. The first thing we suggest you do is ask the person selling the car to go to an insurance broker to replace the missing vehicle registration. If you’re unable to contact the seller, that’s OK. Your Nakamun Group insurance broker can help direct you in the steps you need to take, which will differ in each province.

You both do. And the easiest way to complete your sale is to go to your Nakamun Group insurance broker together with the buyer and handle all of the paperwork in the broker’s office. Don’t forget to bring your plates!

Yes you can, as long as the vehicle is roadworthy and operationally safe, with no structural damage. The cash settlement amount will take into account the cost of repairs, excluding taxes. Ask your adjuster to find out what your cash settlement would be and then you can decide if you want to fix your vehicle yourself.

Unfortunately, no. Although we understand you might want to help your friend out and make the claim under your insurance, you wouldn’t be able to. Although the rules can change depending on where you live, the responsibility for a claim usually goes to whoever the car is licensed and insured to (your friend), not to who’s driving it at the time and gets in the crash (you).

Since the golf club most likely can’t be held responsible for damage caused by any players on its course, you should make a claim. The good news is that you’re protected by own Comprehensive insurance, which will cover the repairs for damage caused by flying objects like golf balls.

You could receive a traffic ticket. To learn more, review the seatbelt laws in your province. The courts would determine if you were responsible for contributing to a passenger’s injuries by not making sure they had their seat belt on, considering the circumstances of the crash, including the age and competence of the passenger. Keep in mind a passenger without a seatbelt poses a high risk to everyone a vehicle in the event of a crash. If you were in a head-on collision at 50 km/h, a 150-pound passenger not wearing a seatbelt would strike you or other passengers in the vehicle with the same weight as a 3 ½-ton truck.

When you buy coverage for damage to your own car, you choose a deductible amount. This is the uninsured portion of a claim and the amount you pay before your insurance policy comes into effect to pay for the rest. Having deductibles is standard in the insurance industry and helps keep insurance affordable. If the other driver is at fault and insured by us, your deductible may be reimbursed or waived. If the other driver doesn’t have insurance with the same insurance company, you or your adjuster need to request the reimbursement of your deductible from the other driver’s insurance company.

You don’t always have to call the police. However, you are required to make a police report in the following cases:

- There has been a death or someone has been taken to the hospital by ambulance

- It was a hit-and-run accident

- Someone broke into or vandalized your vehicle

- Your vehicle was stolen

A good rule of thumb is to call the police if you think the damage to your vehicle looks like it may be more than $1,000 (or $600 for a motorcycle and $100 for a bicycle). If the police don’t come to the accident scene, call your insurance company to find out if you have to get a police report.

A scooter is a limited speed motorcycle powered by gas engines 50 cc or less or electric motor less than 1,500 watts. All limited speed motorcycles need to registered, licensed and insured as a motor vehicle and the operator needs a driver’s licence.

Depending how often you do work-related deliveries, you might need more coverage. With pleasure use, you can also use your vehicle for limited commuting, business use and deliveries up to six days in a calendar month.

If you are responsible for the crash, it covers the other motorist’s repairs, the cost of damages and any injuries caused as a result of the crash. It is important to know that the costs of a claim can exceed the usual $200,000 liability that many people buy. For example, if your accident caused serious injuries to multiple parties, each one could sue you for the cost of their care, and it could involve lifetime care costing hundreds of thousands of dollars per person. If you had purchased only the minimum coverage, you would be responsible for the difference.

If your vehicle is off the road, or you intend to put it in storage, a Vehicle in Storage policy is what you want. It includes Collision, Comprehensive, Specified Perils, Basic and/or extended Third Party Liability insurance, as well as Replacement Cost Coverage and Limited Depreciation coverage for certain newer vehicles. The cost for a storage policy depends on the model and age of the car, and where it’s parked. Remember that it needs to be stored on private land and the Vehicle in Storage coverage is void if your vehicle is operated at any time during the policy.

When your teen becomes a new driver, check your coverage with your Autoplan broker to see how your insurance could be affected. You might have a type of insurance discount that no longer applies. For example, your insurance may require that all drivers in your household have 10 years of experience. In that case, you would need to update your coverage. Your insurance is also affected by your vehicle’s principal operator. This is the person who drives it the most. If your teen becomes the principal operator of your vehicle, your premiums will likely increase, because they haven’t driven long enough yet to get discounts for safe driving. Since your teen is a new driver, we also recommend getting some extra coverage, like Extension Third Party Liability or Collision. It helps to protect them, you, and your vehicle.

Your insurance expires at midnight on the expiry date. So yes, you have until the end of the day to get it renewed.

Yes, as long as your son’s friends have your permission to drive your vehicle, then they are covered by your policy. Remember that as the registered owner, you’re responsible and legally liable if someone you lend your vehicle to has an at-fault crash. In addition, it could affect your discount. You’ll also need to make sure anyone driving has a valid driver’s licence and that your car is properly insured for the way they’re using it, such as driving to work.

Term insurance policies cover the insured for a stated term. The most common type of term policies are Term 10 and Term 20 policies. For example, on these plans the premiums are fixed for 10 years or 20 years and they rise substantially as the insured ages. Most Term policies are renewable and convertible, meaning the coverage can be renewed and/or converted to a permanent plan without a medical.

Life insurance can be used for a number of reasons. Here are just a few:

Life insurance can replace your income if something happens to you. It can pay off a mortgage or a line of credit so your loved ones aren’t saddled with the challenge of dealing with it. It can cover your final expenses. It can act as an emergency fund. The money can be used to fund your child’s education. And it can provide estate preservation and creation. Life insurance is seen by many as an unselfish act because the money is not used for the insured, just their loved ones. Finally, it can provide valuable protection for tax liabilities.

In most instances, individual life insurance offers a much better value than mortgage insurance through a lender. Individual life insurance policies provide level coverage, the plan is portable, if you decide to switch homes or move to another bank, and the insurance company allows you to choose your own beneficiary. There are also substantial discounts to non-smokers and people who have a healthy lifestyle.

In contrast, mortgage insurance through the bank offers declining coverage and the bank is the insured party. The insurance cannot be transferred to another lender. Coverage ceases when the entire mortgage balance is paid off, and at that time your ability to get independent coverage may have changed — you may no longer even be insurable! In addition, there are generally no discounts given to non-smokers or people with a healthy lifestyle when obtaining insurance directly from the mortgage lender.

A personal life insurance policy is tailored to your needs, features to take into consideration would be what financial needs your beneficiaries require upon your death — including paying off the mortgage, replacing your income to maintain lifestyle, and providing for dependents.

Most Term policies renew automatically. The insurance company would require you to sign a letter to cancel the policy.

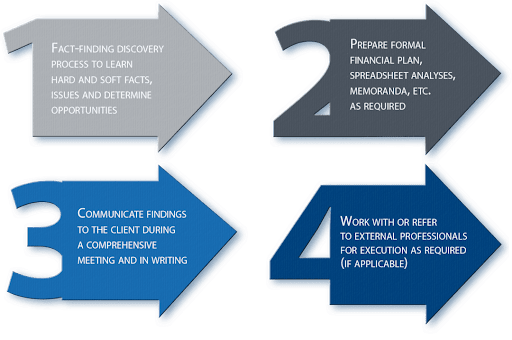

A financial planner is someone who helps clients to manage their personal finances.

FP Canada, the regulatory body for CFPs like us, says that a financial planner is “an appropriately qualified professional [that] has the ability to safeguard and enhance your financial and overall well-being, both today and in the future.”

A financial plan is the cornerstone of a family’s quest for financial independence. Saving and investing are important parts of a financial plan, but there is so much more.

How much do you need to save each week, each month, each year and ultimately, how much do you need saved to retire by a certain age? Should those savings be allocated to debt repayment, employer RRSP / pension plan, personal RRSP, spousal RRSP, children’s RESP, or TFSA? These are just a few of the typical choices.

What’s your investment strategy? Have you addressed areas such as asset allocation, product selection, tax efficiency, fees, estate implications and performance? Are you aware of the current investment options in the Canadian marketplace

Is your financial plan tax-efficient, or are there things you should be doing differently, either individually or as a family?

Most importantly, what happens if you become sick, injured or disabled, or worse, if you die? Will your family’s financial plan still be on track?

A financial plan is a comprehensive projection over the long term that identifies and projects your income, expenses, assets and liabilities and how these four areas come together on an annual basis for the rest of your life. It can be used to make decisions in either the short run or the long run. It is chock full of numbers if you like the detail, but it also has charts and graphs if you are more visual.

Not at all.

Our clients have a net worth ranging from zero to several million dollars.

- Retirement planning

- Investment strategy

- Tax planning

- Insurance needs

- Estate planning

- Other services as required

Contact our Financial Planning office today.